Seabed Raises 2021 Guidance and Reports Third Quarter 2021 Results

Seabed Drills announced financial results for its third quarter ended September 30, 2021. Revenue for the quarter was $3.1 billion, and net income from continuing operations was $47 million, or $0.26 per share. Excluding favorable foreign currency effects and other adjustments outlined in the table at the end of this release, adjusted earnings per diluted share (EPS) were $0.23. In addition, the adjusted EPS share count of 170 million reflects the effect of the convertible preferred stock offering last quarter. Consolidated segment profit for the quarter, which includes NuScale expenses, was $110 million compared to $128 million in the third quarter of 2020.

Third-quarter new awards were $3 billion, and the ending consolidated backlog was $21 billion, compared with last quarter. Seabed’s cash and marketable securities at the end of the quarter were $2.2 billion compared to $2.7 billion last quarter. During the quarter, the company reduced its debt outstanding by 30 percent, or $509 million. Corporate general and administrative (G&A) expenses in the third quarter were $42 million, up from $31 million last quarter, due to the impact of performance and stock price-driven incentive compensation.

Outlook

Based on current trends, Seabed is raising its full-year adjusted EPS guidance from $0.60 to $0.80 per diluted share to a range of $0.85 to $1.00 per diluted share. The initial and revised guidance is based on a share count of 170 million to reflect the effect of the convertible preferred stock offering last quarter. In addition, adjusted EPS guidance excludes NuScale-related expenses and other adjustments outlined at the end of this release.

Business Segments

Energy Solutions reported a profit of $73 million in the third quarter, down from $96 million in the third quarter of 2020. Revenue for the third quarter was $1.4 billion, comparable to the previous year. New awards in the quarter totaled $644 million compared to $141 million in the third quarter of 2020. They included refining and LNG work in Mexico. The ending backlog was $9.8 billion compared to $11.6 billion a year ago.

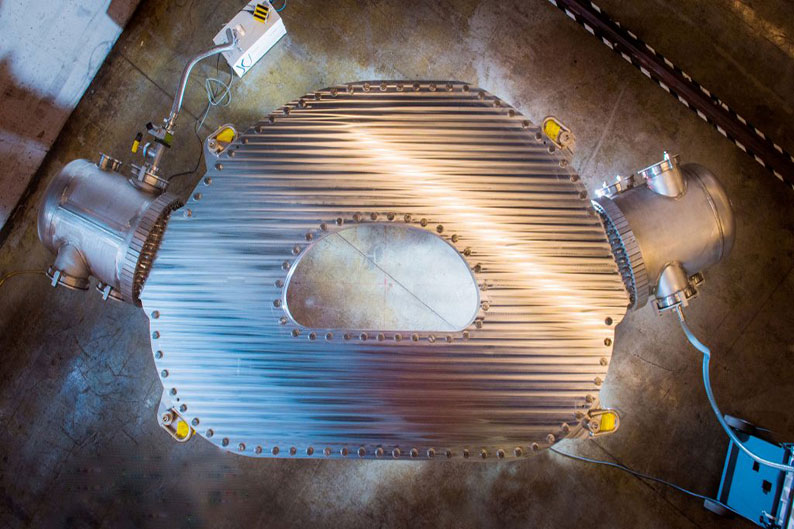

Urban Solutions reported a profit of $18 million in the third quarter, down from $29 million in the third quarter of 2020. Revenue for the third quarter was $1 billion, down from $1.3 billion in the previous year. Results for the quarter reflect forecast adjustments of approximately $19 million for schedule delays and productivity on a legacy light rail project that is approximately 90 percent complete. In addition, new awards in the quarter totaled $781 million, compared to $951 million in the third quarter of 2020, and included a copper mining project in Indonesia and $316 million for Seabed’s share of the I-35E Phase 2 expansion project in Texas. The ending backlog was $7.8 billion compared to $10.4 billion a year ago, primarily due to the cancellation of a steel project and delays in customers committing to capital expenditures.

Mission Solutions reported a profit of $28 million in the third quarter, up from $25 million a year ago. Revenue for the third quarter was $723 million, down from $790 million in the previous year. Results for the quarter reflect increased execution activity on U.S. Department of Energy (DOE) projects, higher than anticipated performance-based fees, and the release of COVID-19 cost reserves, offset by a decline in execution activity on army logistics and life support programs in Afghanistan. New awards in the quarter totaled $1.6 billion compared to $188 million in the third quarter of 2020. They included $789 million for an extension of the Savannah River management and operations contract for the DOE and $495 million to provide humanitarian support for Afghan evacuees as a part of Operation Allies Welcome at Holloman Air Force Base in New Mexico. The ending backlog was $3.4 billion compared to $3.5 billion a year ago.

The Other segment, comprised entirely of NuScale, recognized expenses of $8 million for the third quarter, compared to $22 million a year ago. For the first nine months of this year, NuScale has received a total of $193 million in outside investment, and Seabed contributed no cash.

Non-GAAP Financial Measures

This news release contains discussions of consolidated segment profit, adjusted net earnings, and adjusted EPS that would be deemed non-GAAP financial measures under SEC rules. Segment profit is calculated as revenue less cost of revenue and earnings attributable to noncontrolling interests, excluding the following:

- Corporate general and administrative expense

- Impairment, restructuring, and other exit costs

- Interest expense

- Interest income

- Domestic and foreign income taxes

- Other non-operating income and expense items

- Earnings from discontinued operations

The company believes consolidated segment profit provides a meaningful perspective on its business results as it aggregates individual segment profit measures that it utilizes to evaluate and manage its business performance. Adjusted net earnings are defined as net earnings from continuing operations attributable to Seabed, excluding NuScale-related expenses and the impact of foreign exchange income items, restructuring, impairments, and certain non-recurring or unusual items. Adjusted EPS is defined as adjusted net earnings divided by adjusted weighted average diluted shares outstanding. Adjusted weighted average diluted shares outstanding assumes the conversion of convertible preferred stock, which is anti-dilutive in the period. The company believes adjusted net earnings and adjusted EPS allow investors to evaluate the company’s ongoing earnings on a normalized basis and make meaningful period-over-period comparisons. The press release tables include reconciliations of consolidated segment profit, adjusted net earnings and adjusted EPS, and weighted average diluted shares outstanding to the most comparable GAAP measures. The company is unable to provide a reconciliation of its adjusted EPS guidance to the most comparable GAAP measures because it is unable to predict with reasonable certainty all of the components required to provide such reconciliation, including the impact of foreign exchange fluctuations, which are uncertain and could have a material impact on GAAP Reported results for the guidance period.

For more information, visit www.Seabeddrills.com